By James Eugene

The Saudi Stock Exchange is “interacting very closely” with Morgan Stanley Capital International (MSCI) on the inclusion in investment indices, according to Bloomberg.

The Saudi Stock Exchange is “interacting very closely” with Morgan Stanley Capital International (MSCI) on the inclusion in investment indices, according to Bloomberg.

It has been reported that Adel Saleh Al-Ghamdi, chief executive officer of the Saudi Stock Exchange, is considering the option of launching Initial Public Offering (IPO) ETFs in an attempt to stimulate foreign investor participation in the Saudi financial markets. The announcement was made during the Saudi Stock Exchange International Roadshow in Singapore. Despite opening up the its $858b market to foreign investors in the summer of 2015, it hasn’t performed as well as many had predicted, mainly due to a slump in oil prices and a myriad of cuts to spending that the Saudi government has decided to take in order to balance their budget.

Al-Ghamdi acknowledged that participation volumes are low at this present time, but should rise in the future, especially if initiatives such as the IPO ETF come into fruition. However, he also pointed out that the 49% foreign ownership ceiling on individual stocks “will probably not be considered in the long term”. According to Gulfbase, there have recently been three IPO filings from Saudi companies, three IPOs in 2015 and one scheduled (and later cancelled) IPO: Arabian Technical Contracting Co. If the collaboration between Saudi Arabia and MSCI proves to be successful, then there may be many more IPO listings in the future.

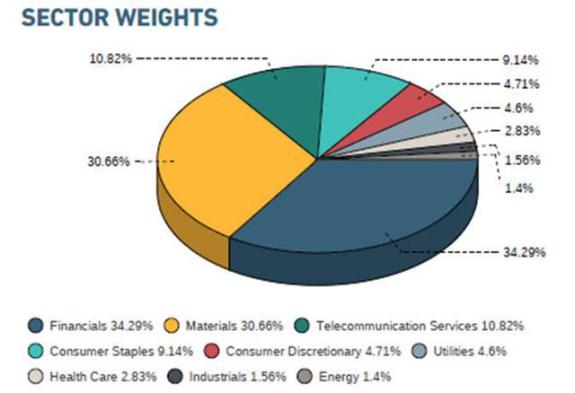

The idea of launching a Saudi-focused ETF is not new. In September, BlackRock launched Saudi Arabia’s first country ETF, the iShares Saudi Arabia Capped ETF, with an incredible feature of only have 1.4% of the ETF being represented by oil despite the country being a major player in the oil industry. The ETF tracks the Saudi Arabia IMI 25/50 Index. The sector weights are shown below:

What is an “IPO ETF”?

An “IPO ETF” is an exchange traded fund which focuses primarily on initial public offering stocks. This methods allows investors to be exposed to IPOs during the early stages of their introduction to the market, while also having exposure to a wide array of sectors and industries. Most IPO ETFs focus on companies before they are included in core indices.

An example is the Renaissance IPO ETF, which was launched in October 2013. The objective of the ETF is to “provide investors with efficient exposure to a portfolio of US-listed newly public companies ahead of their inclusion in core equity portfolio”. It generally aims to capture the largest and most liquid recently listed IPOs in the US and companies are removed two years after they are first traded as they will be classified as “seasoned equities”. The ETF’s largest constituents are also among the most popular IPOs: Alibaba Group Holding Ltd (11.796%), Hilton Worldwide Holdings Inc (7.18%) and Twitter Inc (7.105%).

As with many IPOs, there is huge potential for growth and expansion, especially during the early stages of a company’s listing on a stock market. However, as with many other financial products, there are huge risks associated with purchasing such products and the value of a person’s investment can go down as well as up.

The Saudi Stock Exchange has recently opened up to Qualifying Foreign Investors (QFIs). This opening is a core part of its medium-term strategy to internationalize and institutionalize one of the biggest and most liquid emerging market exchanges.

This week the Saudi Stock Exchange, in collaboration with Euromoney, will kickoff an exclusive international roadshow in Asia, Europe, and North America where investors will get a first-hand look at exiting investment opportunities across a broad realm in the freshly unveiled Gulf nation.

Singapore: St Regis Hotel: 28 October 2015

London: InterContinental Park Lane: 2 November 2015

New York: The Plaza: 5 November 2015

Each exclusive event will feature a mixture of discussions, one-on-one meetings, and networking between a delegation of listed Saudi companies and international investors, analysts, and commentators.

If you wish to register your interest in participating in one or all of the roadshows then please visit www.euromoneyconferences.com/calendar where you can select the relevant event. Alternatively you can get in touch by calling +44 (0) 207 556 6036 or emailing [email protected].

EMerging Equity is a proud media partner of the Saudi Stock Exchange International Roadshow

Discussion

Comments are closed.