By James Eugene

The Saudi Stock Exchange (Tadawul) announced on Monday that it plans to create a stock market for small and medium sized companies, with the intention of launching this new market at the beginning of 2017.

The Saudi Stock Exchange (Tadawul) announced on Monday that it plans to create a stock market for small and medium sized companies, with the intention of launching this new market at the beginning of 2017.

Given the growing importance that SMEs are displaying for Saudi Arabia’s economy, the Tadawul will be undertaking a “market awareness campaign” directly aimed at SMEs, with the primary goal of highlighting “the value of listing in this market for SMEs in order to support their continuity and development; and the potential investment opportunities for investors”.

The objectives of this new initiative, which has support from the Capital Market Authority, are to:

- Improve the competitiveness of SMEs

- Open up new channels and methods of obtaining finance for expansion and growth

- Reinforce corporate governance and disclosure standards

After speculation that Saudi Arabia could potentially miss out on being included in the MSCI Emerging Market Index, the Middle Eastern nation is doing all it can to prove to international investors that it is serious about opening up its markets and making investing in the country much easier. This follows a range of plans and proposals, such as: announcing an initial pubic offering (IPO) in one of the most lucrative companies in the world, Aramco; making an attempt to diversify its economy away from oil; and potentially launching a new product, the IPO exchange traded fund (ETF). Due to the recent collapse in global oil prices over the past two years, Saudi Arabia’s push to promote SMEs, alongside diversifying its economy, seems like a logical step.

Saudi Arabia Could Miss Out On MSCI Emerging Market Inclusion http://t.co/PbA8KwzWSD #EmergingMarkets #FrontierMarkets #MiddleEast

— James (@James_Eugene) February 12, 2016

Saudi SME Fund

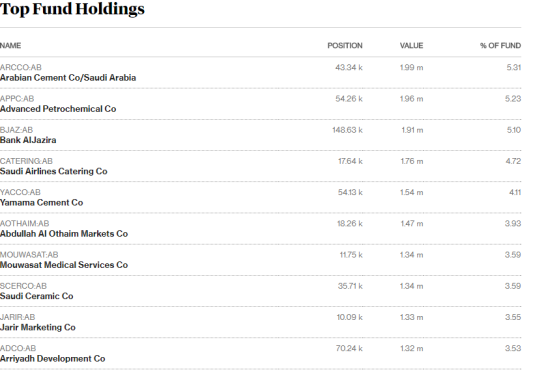

The Riyad Small and Medium Cap Fund provides investors with a chance to increase their exposure to a high risk environment in the Middle East, with more focus on Saudi Arabia. For example, the fund invests primarily in stocks of small Saudi companies with a market capitalization that does not exceed 3bn riyal (as well as Gulf companies that do not exceed this value) and medium sized companies with a market capitalization between 3bn and 50bn riyal. The fund’s largest holdings are Arabian Cement Company, Advanced Petrochemical Company and Al Jazira Bank, contributing a combined total of 15% in the fund.

Riyad Small and Medium Cap Fund’s Top 10 Constituents

If Tadawul’s plans come into fruition next year, then we may see many more Saudi Arabian SME funds being launched in order to take advantage of the possible gains (and risks) that are associated with investing in such companies.

Discussion

No comments yet.